Online Gambling Market Europe

- Online Gambling Market Europe 2020

- Online Gambling Market Europe History

- Online Gambling Market Europe 2019

- European Online Gambling Market Size

DUBLIN--(BUSINESS WIRE)--Nov 13, 2020--

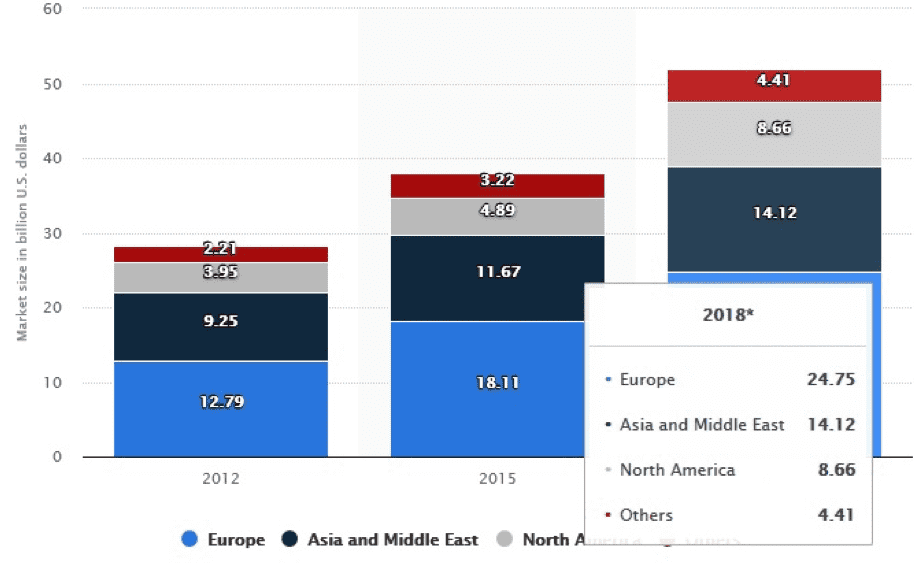

As gambling becomes more and more of an online activity, markets such as the European Union are projected to grow at about 10% per year, and increase to nearly US$35.5 billion by 2022, up nearly 32% from its 2018 numbers. Globally, the online gambling market is projected to reach US$160 billion by 2026. The 'Europe Online Gambling Market Growth, Trends, and Forecast (2020-2025)' report has been added to ResearchAndMarkets.com's offering. The European online gambling market is projected to grow.

The “Europe Online Gambling Market - Growth, Trends, and Forecast (2020-2025)” report has been added to ResearchAndMarkets.com’s offering.

The European online gambling market is projected to grow, witnessing a CAGR of 9.20% during the forecast period (2020-2025).

Growing hardware and software innovations and the rising popularity of casino and sports betting gambling, along with enhanced internet penetration, are expected to drive the growth of the European online gambling market.

The dominating players have been focusing on mergers over the past few years, primarily to increase their stake in the market and to improve profit margins. For instance, Paddy Power PLC and Bet fair PLC merged to form Paddy Power Betfair PLC.

In order to gain a competitive advantage and compete with the established players, companies are developing innovative offerings in the region. For instance, in April 2019, one of the UK’s leading casino companies, 888 Holdings, had signed up a new gaming partnership with software maker, Microgaming.

Key Market Trends

Desktop Devices Holding The Major Share

Online gaming started on desktop computers, and many online casinos still focus most of their development on making sure that players get a smooth and well-presented user-interface experience. Desktops and laptops are considered to be the most convenient devices for online gambling owing to their bigger screen size. This factor provides the gamer with the ultimate online gaming experience.

One of the major benefits of using the desktop as an option to play online casino is that the number of mobile casino games on offer is significantly fewer than desktop gaming. Moreover, some of the mobile casino games only offer a few selections of the deposit options as compared to a desktop site. However, rising penetration of smartphones, owing to its convenience, is affecting the growth and demand for the gambling market operated through desktops/laptops.

United Kingdom Leading The Market

Sports betting in the United Kingdom is provided by the private sector and is conducted within a very competitive market. Online gambling is legal and regulated in the country by the Gambling Commission, which was formed by the Gambling Act of 2005. Online poker, sports betting, casino games, bingo, and lottery-style games all fall under the purview of the Gambling Commission.

As per the data published by OfCom (The Office of Communications, United Kingdom) in 2015, 6% of the users aged between 25-34 and 45-54 years engaged themselves in online gambling at least once in every three months. The second highest age group was between 16 and 24 years, which accounted for 4%. Rizk Casino, 888 Holdings, Casumo Casino, bet365, and LeoVegas are some of the prominent players operating in the UK online gambling market.

Competitive Landscape

Bet365, 888 Holdings Plc, GVC Holdings PLC, Kindred Group PLC, William Hill PLC, and Betsson AB are some of the major players having a significant presence across Europe. nMany online gambling companies rely on third-party providers, such as Playtech, for software solutions. However, some companies choose to backward integrate with technology providers.

For instance, 888 Poker heavily invested in developing its own software and online gaming technology, primarily not to rely on suppliers. Similarly, William Hill, a bookmaker company located in the United Kingdom, was focused on backward integration, and thus, acquired Grand Parade, a software development company, in 2016.

Key Topics Covered:

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

4.1 Market Drivers

4.2 Market Restraints

4.3 Porter’s Five Force Analysis

5 MARKET SEGMENTATION

5.1 By Game Type

5.1.1 Sports Betting

5.1.1.1 Football

5.1.1.2 Horse Racing

5.1.1.3 E-Sports

5.1.1.4 Other Sports

5.1.2 Casino

5.1.2.1 Live Casino

5.1.2.2 Baccarat

5.1.2.3 Blackjack

5.1.2.4 Poker

5.1.2.5 Slots

5.1.2.6 Other Casino Games

5.1.3 Lottery

5.1.4 Bingo

5.2 By End-use

5.2.1 Desktop

5.2.2 Mobile

5.3 By Geography

6 COMPETITIVE LANDSCAPE

6.1 Most Active Companies

6.2 Most Adopted Strategies

6.3 Market Share Analysis

6.4 Company Profiles

6.4.1 Betsson AB

6.4.2 888 Holdings PLC

6.4.3 The Stars Group Inc.

Online Gambling Market Europe 2020

6.4.4 The Kindered Group

Online Gambling Market Europe History

6.4.5 GVC Holdings

6.4.6 William Hill PLC

6.4.7 Bet365 Group Ltd

6.4.8 LeoVegas AB

6.4.9 Flutter Entertainment

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

For more information about this report visit https://www.researchandmarkets.com/r/yna583

View source version on businesswire.com:https://www.businesswire.com/news/home/20201113005390/en/

CONTACT: ResearchAndMarkets.com

Online Gambling Market Europe 2019

Laura Wood, Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

European Online Gambling Market Size

For U.S./CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

KEYWORD: EUROPE

INDUSTRY KEYWORD: CASINO/GAMING ENTERTAINMENT

SOURCE: Research and Markets

Copyright Business Wire 2020.

PUB: 11/13/2020 07:53 AM/DISC: 11/13/2020 07:53 AM

http://www.businesswire.com/news/home/20201113005390/en